- Geo Coelho

- Posts

- 5 critical questions for your consumer crypto app.

5 critical questions for your consumer crypto app.

A crash course on the unique challenges of growing consumer web3 projects, and how to design for them from the start.

So, you’re building a consumer crypto app. Something simple and streamlined… without all the scary complexity, bad UX, and connotations of “crypto”.

We all want to see mainstream adoption, and we all believe it will happen. But for now - we’re still on the frontier. Growing consumer products in web3 is exciting, it is fascinating, it is… different.

I’ve spent years on projects with this mission. A/B testing, refining, scaling, optimizing, through bear and bull markets. Designing incentives. Fighting the good fight of making “crypto” accessible.

Building here means you’ll have all the same challenges of creating and growing a great web2 product, plus some new ones, in an environment that breaks many of the core assumptions of how you can measure.

To be completely clear - no one has really succeeded yet. There are leaders in consumer web3 today; there are no winners yet. Products have skyrocketed to popularity - few have retained audiences.

Price will not get us there. Designing for where, why, and how web3 products can outcompete incumbent systems, will.

I’ll do more step-by-step guides in following posts. To start, this is an introduction to the most important questions you should be asking at the earliest stages, and why - so that when it does come time to scale, you can.

The five critical questions you should be able to answer about your consumer crypto product:

These may seem basic on first glance - but each relates to specific, recurring challenges in this space, which I’ll break down below. By considering them from the start, hopefully you can successfully push the boundaries further - for yourself, and those behind you.

And, look: this post is not intended to dissuade you from building something, especially if you’re having fun - we need games, too. It is simply intended to help guide anyone who is setting out to build a venture-scale project, because that’s where my experience comes from.

If this post is too long, just scroll to the TL;DR summaries at the bottom of each section. I’ve included examples.

Let’s dig in.

1. How does web3 improve your solution?

Early web3 pioneers, pictured with the new “faster horse” their customers requested.

Emphasis on “solution”, because your product solves a specific problem.

Despite what you may read on twitter X, not everything needs to be onchain, today. Infrastructure is improving, there is broader adoption and liquidity of the base assets; both steadily pave the way for better consumer apps. But, web3 will still make many aspects of your product unnecessarily difficult for the average person, if it doesn’t make your product better.

It’s hard enough to build a successful consumer product without adding transaction costs, hexadecimal addresses, gas currencies, wallet signing, pseudonymity, market volatility, self-custody, and app store restrictions.

The smartest people in the world have made the internet progressively and continuously easier to use for the last three decades. The web is faster, cheaper, more stimulating and ubiquitous than ever. Payments in the US, and much of the world, are actually quite easy, and cheap.

Yet web3 culture has maintained an ongoing expectation that people will adopt an objectively more difficult experience, in exchange for what much of the public might consider philosophical improvements. We’ve seen over and over again that people like the ideas of privacy, decentralization, and self-custody… just not at the expense of speed, ease, or cost.

Building onchain today will most likely reduce your addressable market, add friction to your conversion funnel, and make it generally far more difficult for you to measure product/market fit.

This doesn’t mean it’s not worth it, but it does mean you need to think critically:

What aspect(s) of web3 makes your product an authentically superior solution?

Why is this a necessary feature from the start?

Will it make your product a better enough (10x) solution to justify switching costs?

If you have a clear answer - you’re far ahead of many projects today. If you don’t have a concrete answer - you might need to reevaluate.

If your answer is:

“decentralization”, “self-custody”, “privacy” → you need strong validation your target customers really want, and are actually willing to pay for this.

“mainstream adoption of web3”, or “access to startup capital” → these are not actually user problems.

Your goal has to be creating a better solution to a specific problem, for a specific set of people. “Mainstream adoption” of web3 will only be achieved through applications that authentically outcompete their web2 competitors.

What types of applications can actually benefit from being onchain? A full blog post on this is coming soon™ - but I’ve included a quick example below.

TL;DR Part 1:

If you are building a crypto product for the “mainstream”, consider what benefits of being onchain will provide a strong enough advantage, to outweigh the added friction and complexity you’re likely adding to the experience.

Who is doing this well today?*

Polymarket, the world’s largest prediction market, entered the mainstream as a key source of information during the recent US presidential election.

In an already compliance-heavy industry, prediction markets have uniquely complicated and opaque regulatory requirements that vary by geography. This makes licensing and compliance slow, and cost-prohibitively expensive for all but the most highly-funded projects.

However, as a decentralized trading protocol, Polymarket never holds user funds - they simply provide software people can use to trade directly with one another. This makes their markets far more difficult to freeze or shut down, and has allowed them to move significantly faster than centralized competitors like Kalshi.

This is not a coincidence. Removing third parties, specifically due to the high cost of mediating transactions, is precisely why Satoshi created Bitcoin. This is literally the first paragraph in the white paper.

*Unfortunately, Polymarket founder Shayne Coplan was raided by the FBI last week. However, true to the statements above, Polymarket is still up and live.

2. How experienced is your target audience?

Veteran and new web3 explorers in the average discord. Everybody say GM!

More accurately, how “crypto-initiated” is your target audience?

This should impact every other aspect of your product, GTM, and brand strategy. You can always expand… you must start narrow.

Many consumer apps end up spending a massive amount of time and resources on educational materials to help people feel safe, motivated, and knowledgeable enough to actually use their product. Newsletters, push notifications, podcasts, social content, videos… you name it.

Converting new users is significantly more difficult in web3. And for many products, the only thing worse than their conversion rates, are their retention rates.

For now, let’s focus on why crypto-initiation level will affect A) your conversion funnel, and then B) the priorities of the audience you reach.

A) Conversion funnel: Specifically, funding the wallet.

The difference between even a mildly-experienced audience, and brand-new users, will be their ability to get funds into your app.

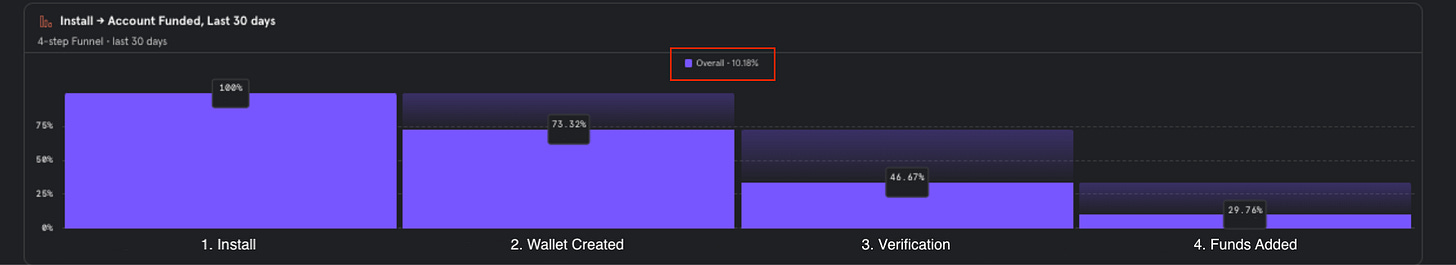

A standard activation funnel with a 10.18% conversion rate from install → funded.

Historically, this step will prevent 90% of “normal” people from ever using what you’ve actually made. This means your real CAC is 10x higher than your cost per install.

Before we go deeper, a quick, too-simple breakdown of audiences you’ll reach:

Crypto-advanced:

They already have funds in a wallet, hopefully on the same chain you’re building on. They can send funds, or import their wallet directly in your app. They’re familiar with needing a gas currency. They might have to now pay for gas in order to use your product, but they don’t have to make a larger, up-front purchase, or complete KYC.

Crypto-initiated:

They’ve purchased crypto before, so hopefully they can easily do it again. But, let’s be realistic, it’s probably on an exchange.

So, they still have to log into a different product, pass that product’s security measures, send their funds, and wait for the transaction to settle before they can use your product. This will still probably be the fastest and least expensive way for them to get started. They may still be new to things like gas currencies and self-custody.

Brand-new:

Starting from 0 isn’t just an education barrier. You have more, and higher-friction steps they have to accomplish before they can get started: completing KYC, and purchasing crypto.

These will either be two separate steps in your app, or they will have to complete both with the third party they’re purchasing from.

If you’re building a product yourself, you probably completed KYC years ago. You might now underestimate how much effort that is for the average person.

KYC isn’t that difficult, but it’s still typically 40% - 50% of total taps/clicks in the onboarding process of most apps (if you’re designing well). You will lose a few people with every required tap, and it’s mildly intrusive: they’re going to have to submit personal information and a photo ID. That means they need to be in a place and situation where they have their ID, feel comfortable pulling it out, trust both your app and the third party KYC provider, and are willing to spend 30 seconds to a few minutes doing it.

I’ve typically lost 20% - 50% of new users at the KYC step, depending on market conditions.

From there, your user now still has to make an actual, up-front purchase. The price and fees of that transaction will be a function of expedience, your monthly volume, exchange rates for their national currency, liquidity of the asset they’re swapping into, and the amount they want. Lower amounts will have a higher percentage fee (i.e. $2 for a $20 cash-in → a 10% fee; twice the interest those funds will yield in a year as stablecoins). The good news: if they passed KYC, they’re probably motivated enough to complete this; the bad news is you’re still going to lose another 10-50% of people who made it this far.

You will also need to plan for the other direction - withdrawing funds. If you think new users are intolerant while getting money into your app, I assure you, they are far less forgiving of issues in getting money out.

TL;DR Part 2A:

As a consumer application, your cash-in flow will make or break your product before the vast majority of people even get the opportunity to experience what you’ve actually built.

The more crypto-initiated your target audience, the less of a problem these steps will be, but you still need a strong enough offer to get most people through. Keep in mind that historically, people have only jumped through these hoops because they believe life-changing money is on the other side.

Plan for this friction from the start. In choosing your target audience, but also in crafting your onboarding experience. Create triggered welcome instructions and reminders from the start, particularly if people will need to complete KYC.

In my experience, 89% of users who will ever activate, do so in the first 48 hours… and 80%+ do so in the first 4 hours.

The friction of this step gives the early players who own the on/off ramps, an extreme advantage. Consider whether you’re competing with a product they own.

B. Audience Characteristics

A crypto-initiated audience will have an easier time accessing your product for the first time.

But this audience is also likely to be primarily financially motivated. Early-stage crypto projects are risky, so potential returns have to be high enough to justify the risk. High single-digit returns might be enough, depending on the asset - low single digits are probably not.

If there’s no gold, the 9,736 “unique” wallets in this photo are headed to different hills.

If incentives you add are not a core aspect of your offering, it will be much harder to differentiate whether people are actually interested in your solution, or simply taking advantage of the promo (but to be clear, it’s probably the promo).

Otherwise, a crypto audience will generally have more:

Builders:

Crypto has a disproportionate number of builders and enthusiasts. People exploring out of a general interest in what’s being built - for inspiration on their own project, a potential job at your company, or to build their own reputation in the space - rather than a direct need for what you’re making. It’s still a very good thing to have people interested like this - they can help refer others, provide feedback, and identify issues - just keep in mind that the smaller your user base, the greater the percentage of your audience this will be.

Airdrop Hunters:

Many “real” crypto users are simply looking for airdrops and farming opportunities - that’s where the space has “found” market fit right now. If there’s any chance you’ll do an airdrop later, or you have a token from the start, they want to make sure their wallet is connected and they’ve completed any core actions likely to qualify them for a reward. They may try to do this through multiple wallets, or as many wallets as they can.

Incentive Farmers:

If you’re offering any kind of referral reward or incentive with actual value, you should build in a fixed cost for participating - if you’re interested in even pretending you have unique users. If your program can be exploited, it will be, programmatically, until all rewards are gone.

Men, 20-45 years old:

There are exceptions, but crypto users on average are still predominantly male, educated, and 20 - 45 years old. Your audience is likely to skew male and toward a pretty stereotypical “crypto” demographic.

My advice, with this in mind:

Collect contact information: You don’t have to require this, but it will help you in actually reaching your audience to understand usage, validate hypotheses, and improve your core offering. Having even limited contact information will allow you to warn people about bugs, nurture new users, introduce product updates, send announcements, and maybe even reactivate people later if they churn. If you require it, you’ll have a more accurate count of unique users - if that matters to you.

Target for more than just crypto-initiation: If you target for only a general interest in crypto, you will reach a lowest-common-denominator segment of people only looking for quick money. Target based on your competitors, AND relevant topics, accounts, or influencers. Include demographic requirements, your geographic focus, and anything else relevant to the core value (see next section) of what you’re building.

TL;DR Part 2B:

Crypto-newbies will be significantly harder to onboard, but they also might be more authentically interested in what you’re building, if you’re building a solution - only you can answer this.

A crypto-initiated audience will be able to onboard faster, but if you’re not offering asymmetric returns, they are more likely to churn (quickly), or not engage at all.

If you won’t be able to abstract away the “crypto” - ideally, there is a large enough cross-section of crypto-initiated users who also have an interest in what you’re doing. Facebook ads are a good way to estimate the size of this cross-section (it’s unlikely you’ll be able to run ads with them, but you can still look at the audience segment size without publishing).

Either way - make your onboarding experience as easy, and as fast as possible. It’s crazy that I have to say this, but - collect contact information so that you can communicate with the people you’re building for. When conversion rates are this low, a shot at reactivation later is worth a few lost points in your conversion rate. Just do it securely.

Who is doing this well today?

Rodeo is doing for instagram, what Farcaster did for Twitter. And they’ve taken one of the more clever approaches to onramping I’ve seen recently. Not only are they using Privy to simplify onboarding/wallet creation, and offering faster onramping with Apple Pay - but their use of “credits” also conceals the fees and exchange rate that users would see and find frustrating, if this value was presented in stablecoins or tokens with a clear exchange rate.

I’ll be dropping my next print series on Rodeo; join me there if you’re curious to follow along.

3. What is the real core value of your product?

This may seem like an easy question, but take a second to really consider it again.

A store of value, a medium of exchange... Most crypto products theoretically do both, and realistically do neither.

Store of value wallets end up encouraging swaps because it’s an easy monetization strategy. Medium-of-exchange products fail because the real costs of gas and on/off ramp fees make the product a worse solution than web2 alternatives.

Culturally, the term “crypto” is so tightly associated with asymmetric returns now, that there is an inevitable gravity toward speculation that permeates everything.

At some point, a new memecoin is going to mint millionaires while whatever you intended to build isn’t quite working yet. It becomes very easy to lean into, “well, speculation is what the people want.”

If you’re embracing this from the start, fine - but if you’re not, consider how that implicit association will affect how you need to design and communicate what you offer.

Realistically, most products here end up providing a way to make money. Either through investing, trading, or completing tasks: users come in with the goal of withdrawing more money than they put in. If this is a fundamental part of your offering, consider how market dependent this makes your solution, why it is economically sustainable, and how it is most likely to be gamed.

But even if the function of your app is financial, the core value is likely still more specific: stability (safety), hedging, gambling, entertainment, or even a sense of community in winning together.

Speak to that value, and not about the underlying technology you’re using to achieve it.

Honest, objective self-reflection on your real core value will allow you to far more accurately separate the valuable features, and acquisition channels, from the trendy distractions.

The best guidance I’ve seen on core value came from Brian Balfour at Reforge. Rather than focusing on your own solution when asking this question, consider what substitute products your audience would use instead.

Gambling, drinks, or entertainment? You’re providing entertainment.

Fashion or luxury goods? Your real value is status.

Savings or traditional assets? You’re selling a better future.

The list goes on - but the lines can get blurry if you’re not careful. Would users still buy that art, if they didn’t believe there was a resale opportunity?

Prioritize features accordingly, and target your audiences accordingly. Bolt-on gamification and incentives will not fix a fundamental misalignment between what you think you offer, and what you actually provide.

TL;DR Part 3:

Deeply consider what core value you’re provide to your users, and whether the incentives you’re creating for them match your intentions. It’s easier than you think to mess this up.

A financial component has a high likelihood of changing the incentives (this goes for anything in life), in a way that makes your product market-dependent, or gameable. Web3 is on a speedrun to test every version of this right now.

Even a core value of “making money” can be broken down into sub categories that are important to consider, and speak to directly. Safety and excitement are opposite values.

Make sure the real value you’re driving is clear, front, and center in your product.

Who is doing this well today?

When it comes to NFTs, I don’t think Blur ever pretended to be about “the art”. The NFT marketplace bills itself clearly as the “marketplace for pro traders,” and dominated NFT sales volume in a matter of weeks with a ruthless focus on providing the best analytics and trading system for high-volume NFT traders.

Blur is not a service for holding NFTs, using NFTs, or creating them. Their features, and token incentives, are singularly focused on providing the most effective tools for making money by buying and selling them. Focus.

4. Who does your product actually compete with?

Sadly, a common mistake I’ve seen is teams assume their product competes only with other web3 apps.

Meanwhile, Reed Hastings famously considered Netflix’s greatest competitor to be sleep.

Who you’re really competing with depends on your answers to the past two questions:

Who your audience is

The core value of your product.

It has very little to do with what underlying technology accomplishes that goal.

Your competitor list should include web3 products, web2 solutions, and maybe even physical goods or experiences your audience currently uses, or could use.

Then, compare:

What is the actual cost of those solutions?

How difficult are they to use? (if it’s software, count the number of clicks or actions to accomplish the goal)

How long do they take to work?

How effective are they?

You don’t have to be better at all of these - but it is critical that you are better at one of them, or there is no reason for anyone to use your solution (And please, keep in mind, this includes the cost of onramping and offramping funds).

Then, consider your competitors’ approach - if they’ve been successful, how? Examine their solutions, the costs, the 1 star reviews, the 5 star reviews, the size of their audiences, the type of content they create, and the level of quality they provide. If something about their solution seems strange or surprising, check if there are regulatory or business reasons you hadn’t considered yet - this is an area you might have an edge.

Focusing only on web3 will give you a very narrow view of the problem, your competition, and your potential audience. Most people don’t really care about the underlying technology of the things they use; they simply want it to accomplish their goal, at the highest quality their price point can afford.

TL;DR Part 4:

Your actual competitors are any alternative solution to the problem you’re solving, that can be used by the people you’re serving.

Realistically, your competitors are probably web2 products, and it’s important to use them as a benchmark for the quality, ease of use, speed, and cost people will expect.

Your solution does not have to solve the problem better, faster, cheaper, and easier than your competitors - but it must do one of these, for you to differentiate and compete.

Who is doing this well today?

I couldn’t wait for Blackbird to launch in San Francisco.

The dining rewards app allows restaurants to “identify, connect with, and reward guests, in meaningful and ongoing ways” - and allows you to earn access, rewards, and status at your favorite restaurants when you dine with them.

Most importantly, Blackbird is clearly designed to compete against Resy, OpenTable, and Yelp, by providing a deeper restaurant experience for an audience of people interested in food - rather than a subset of web3 users who are into food. The app uses web3 tools to deepen relationships - with mintable passes, restaurant subscriptions, and their $FLY reward currency - in a UX that noticeably lacks idiosyncratic crypto language, and makes no mention of “web3”.

5. What are your organic growth loops?

You probably discovered the most famous consumer apps you use, through an organic growth loop: an innate, reinforcing aspect of that product which brought you to their website or app… for free.

Few discovered facebook, tiktok, or reddit through a paid advertisement. Almost everyone joined these platforms via (non-incentivized) invitation, or through the content created and hosted on them.

Natural growth like this isn’t just important for getting “big”; it allows you to test faster, so you can improve faster, which in turn drives more growth. The lower the cost of acquiring new users, the more powerful this becomes.

The most common drivers of organic growth are A) network effects, and B) user generated content.

Network Effects

You’ve probably heard of network effects. They’re famously associated with social networks. But network effects define any product that improves with each additional friend or connection who joins the platform. This gives people a natural incentive to invite friends, family, or anyone else they’d want to use the product with. Common examples include all the famous social networks, but also P2P payment products like Venmo and Cashapp, where utility is directly dependent on the ubiquity of the service.

User Generated Content

User-generated content is less recognized as a growth loop, but it’s similarly powerful in driving organic growth. User-generated content drives organic growth by helping people create things in your product, that will in turn drive more traffic back to the website. One of the best examples of this is Tiktok - people create videos, which are hosted and watched on TikTok - and each video also has a stamp that provides TikTok with free advertising on every other competing channel their videos are reposted to.

Success of your application doesn’t require an organic growth loop, but consumer products often have very thin margins that will require significant adoption before they start turning a profit. If you must reach scale to be able to sustain operations, you need a clear way of getting there.

In web3, traction is more often measured by transaction volume or TVL (Total Value Locked), rather than unique users (a deeper blog post on this, coming soon), but the same basic principle stands. If you expect average consumer transaction sizes to be small, well… the smaller the transactions, the more people, and the higher frequency (i.e. higher engagement) you will need in order to build volume (another topic for a later post).

If you’re focused on consumers and you don’t have an organic growth loop, it may be very difficult to ever reach the levels of growth, and volume you need to sustain operations.

And while it’s disappointing for a fun web2 game or app to close down, the stakes are higher when people are trusting what you’ve built to hold their money. The more viable your company, the safer people will be using it.

TL;DR Part 5:

The most successful companies acquire new users at low cost through organic growth loops - helping them learn faster, improve faster, and reach profitability, faster.

The most common growth loops are network effects - where the product improves with each additional user, and user generated content - where each new piece of content created on the platform helps more people discover it.

Organic growth loops aren’t a requirement for successful products, but they’re usually an important ingredient for products with thin margins that require significant scale before they can become profitable.

Profitability will affect the long term viability of your product, which is particularly important if people are relying on it to hold their money.

Who is doing this well today?

Warpcast is web3’s leading social network today. Most of the zeitgeist still happens on crypto twitter, but tweets are increasingly cross-posted, and the more converts and conversation that occur in warpcast, the stronger the fomo and gravitational pull. Today you will find more earnest builders on Warpcast, and less shilling. Warpcast is also nurturing this loop well, with their emails of recommended posts from people you follow.

I can’t say I’m using Warpcast often enough today, personally - but I’d like to use it more. Join me there and let me know what I’m missing.

At the end of the day, there isn’t one roadmap for success in web3. It should include, and will include, an incredibly broad variety of solutions, and every project has different needs when it comes to planning go-to-market and beyond.

However, right now, these are questions that will directly affect your ability to grow - and more importantly, your ability to find product/market fit, which you have to reach first.

If you have additional questions, comments, or you’d like more content like this:

Find me on Twitter - let me know what you love, or what you hated about this post. I’d love to hear your stories, and any good examples of products I should be using.

Make sure to subscribe if you’d like to be notified about my next post.

Vote here 👇 to help me prioritize which post I should finish next.